Not all individuals are able to save their money, not because they cannot earn enough, but because they use their funds on unnecessary things. Minor and repetitive spending is not clearly noticed but gradually undermines financial stability. Realising that you are spending money like this is a step in a new direction of improved management of money.

Accounts Receivable- Unutilised Subscription Services

There are numerous subscriptions that people pay for when they hardly use them, e.g., streaming or apps, or memberships. The money is stolen away by these little monthly fees. Through regular review of subscriptions, it is possible to know which services are not necessary.

Brand-Name Products Only

It is not necessarily the case that better quality will be paid for in terms of extra money for brand names. Store-brand or generic products are usually of the same or similar performance with a lower price. When buying a brand just because of its image, one ends up spending money unnecessarily. The evaluation of alternatives assists in saving costs without losing value.

Fast Fashion Clothing

Low-cost fashion products are usually of low quality, and they wear out easily. High turnover is costly in the long term. It is cheaper to invest in fewer but high-quality clothes. Fast fashion helps eliminate waste and contributes to improved spending habits.

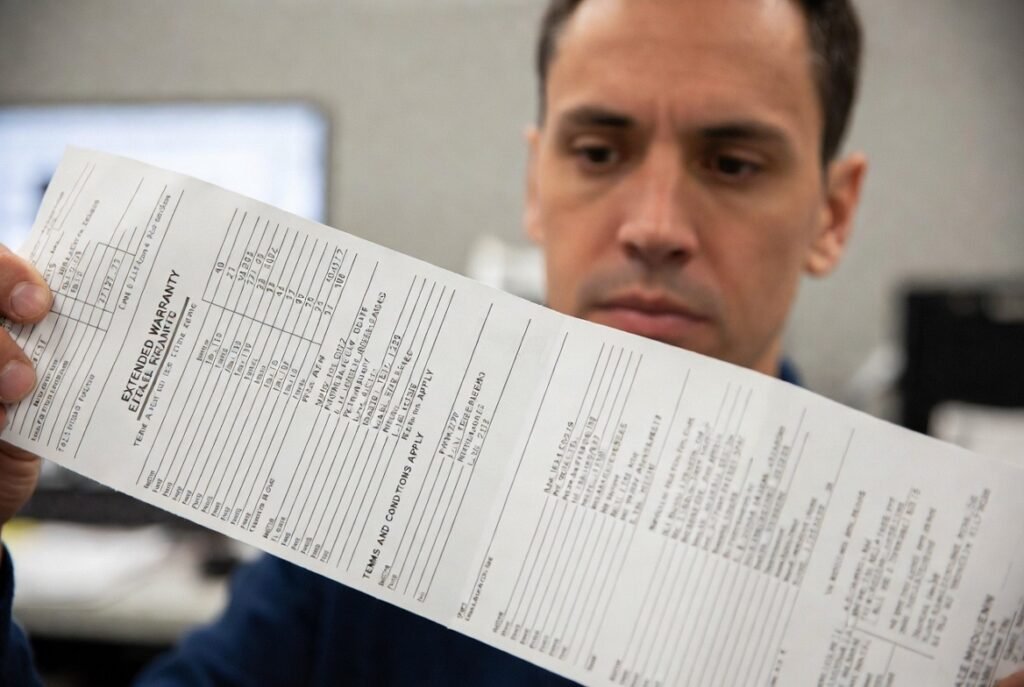

Extended Warranties

Most products do not require extended warranties. There are a lot of products that do not require repairs during the warranty period. Such warranties can be more expensive than the repairs. Omitting them will prevent spending money on protection with low value.

Impulse Online Purchases

It is easy and enticing to impulse buy online. Most of the things that are bought impulsively are hardly utilised. Waiting time before purchase would assist in unnecessary expenditure. Online shopping can be controlled in order to facilitate improved budgeting.

Overpriced Phone Upgrades

The fact that phones have to be upgraded fairly often is hardly necessary. New models are usually slightly improved. Extending devices will help in saving money as well as lowering waste. The discipline to upgrade only when the need arises enhances financial discipline.

Gym Memberships You Don’t Use

Gyms that are not used end up wasting money monthly. I have a lot of individuals registering with good intentions and end up not attending. Alternatives are home exercises or outdoor activities, which are affordable. Unnecessary losses are avoided by cancelling idle memberships.

Convenience Store Snacks

Purchasing snacks at convenience stores is more expensive than shopping in large quantities. Such recurrent minor purchases accumulate fast. One of the best ways to save enough is to plan everything about the snacks in advance.

Premium Cable Packages

The number of cable channels that are not commonly viewed is very high. Entertainment can be achieved by streaming services or low-end plans at a reduced cost. Analysis of the viewing behaviours will save on unwarranted expenditures on idle channels.

Trend-Based Gadgets

Fashionable devices become out of fashion rather quickly. Most of them are short-lived and forgotten. Emphasis on practical buying helps to avoid spending money on short-term trends and helps in long-term financial objectives.