Credit cards don’t simply disappear when someone passes away. The cards continue through a process which depends on account regulations and estate management and financial documentation. The majority of procedures work secretly although their nature appears complicated. Families and executors who understand credit card management procedures will experience greater understanding and fewer unexpected events during their difficult period.

Accounts Are Usually Frozen

The card issuer will freeze the account once they receive notification of the situation. The system stops all new charges while it maintains accurate records until the estate evaluation process is finished.

Authorized Users Lose Access

Authorized users typically can’t continue using the card. Users need the original account holder to access their accounts, which results in suspended activity when their account status changes.

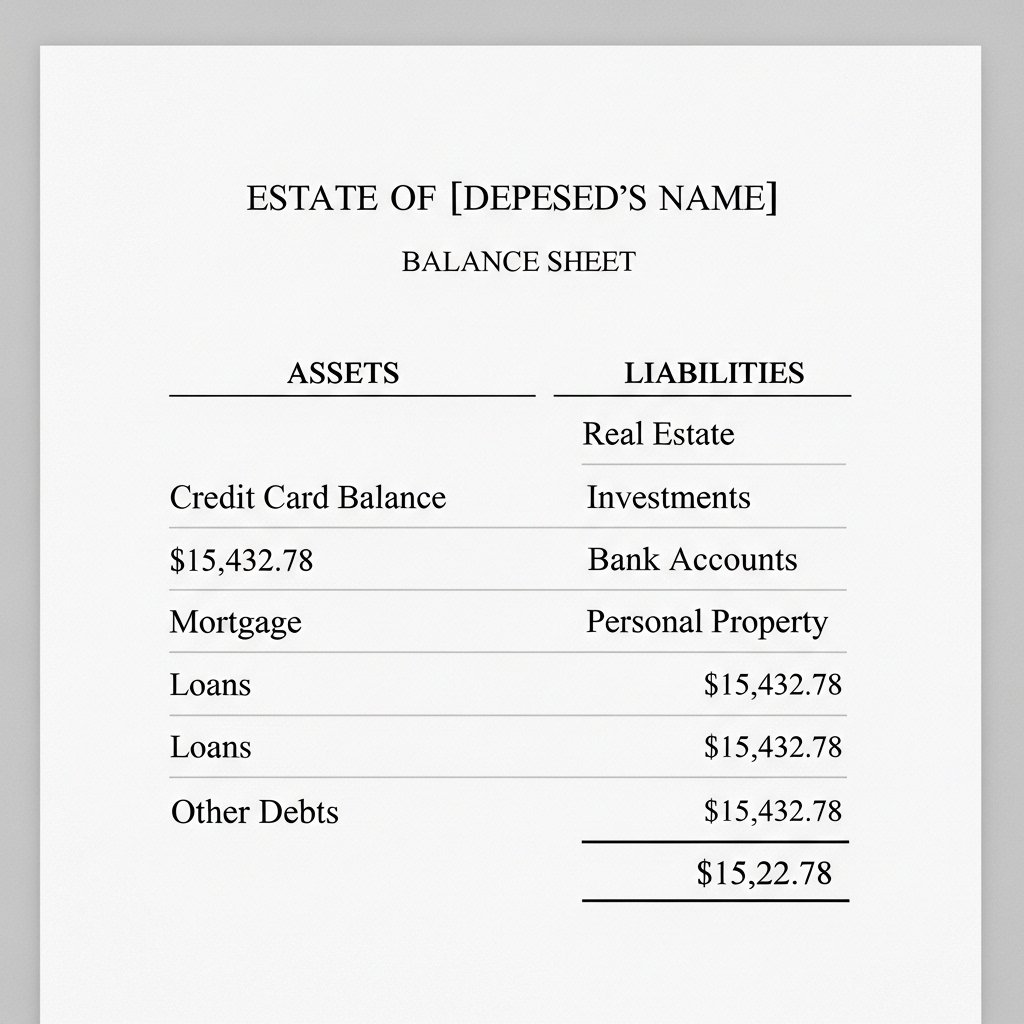

Outstanding Balances Become Part of the Estate

The estate will manage any remaining debt through the estate. The debt will become one of the multiple financial assets which needs evaluation during the settlement procedure.

Automatic Payments May Stop

The system automatically stops all subscriptions and bill payments which use the card once the account terminates. The system requires businesses to examine their ongoing costs which will determine which services need to be stopped or modified.

Rewards and Points May Expire

The account holder remains the owner of all unused rewards miles and points. The benefits will stop working when the account becomes inactive. Hence, it is one of the biggest disadvantages of credit cards when you pass away.

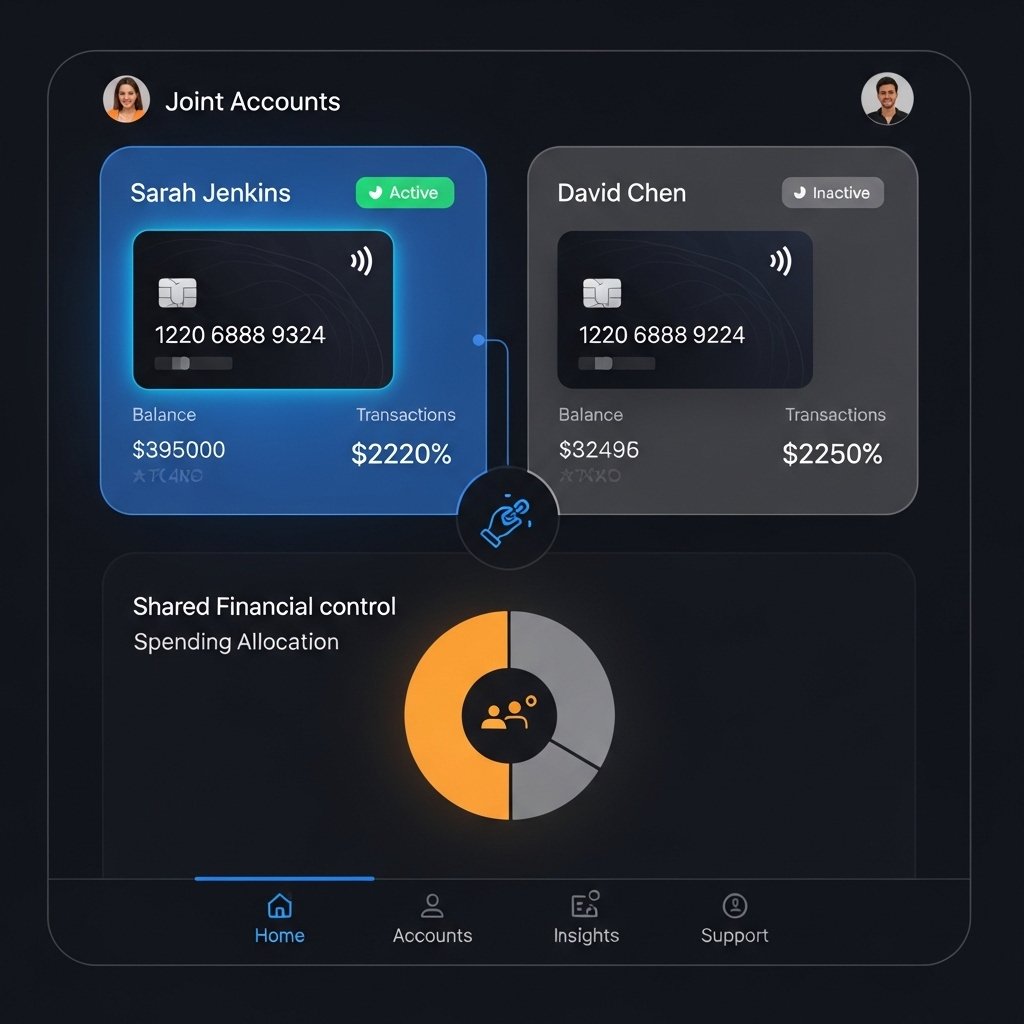

Joint Accounts Follow Different Rules

The surviving account holder retains control over a jointly held credit card after the other holder dies. The account follows different procedures than single-holder cards because it has two active users.

Credit Reports Are Updated

Credit reporting agencies typically mark the account status accordingly. This system maintains correct financial records while preventing later misunderstandings.

Debt Insulation From Family Members After Death

Credit card balances don’t usually transfer directly to relatives. The responsibility remains with either the estate or the person who has legal connection to the account.

Documentation Helps Everything Move Smoothly

Card issuers need death certificates and executor information to update their records. The process becomes more organized with clear documentation which helps maintain straightforward communication.