Many individuals are working hard, but they still feel that they are making little progress. In the majority of the cases, it is not income that is the issue but financial behaviour day to day. Long-term stability is formed as a result of small routines. Some of the habits slowly rob effort into savings, postpone aspirations and erode trust in the future. These trends usually start as something convenient, emotional, or unplanned habits that appear innocent in the beginning. They stifle and inhibit growth and unnecessarily stress in the long run. When one realises these habits, effective changes can start. Financial balance can be enhanced in a gradual change with careful modifications whereby more effective control over costs, improved saving levels, and regularised planning towards long-term security can be achieved.

Ignoring a Monthly Budget

In the absence of a definite monthly budget, expenses are spent in a reactive fashion instead of proactively. This results in missed costs, postponed savings and recurring deficits. Financial confidence gets lost after some time, and most of the important goals become more difficult to reach as there is no organised manner of spending.

Relying on Credit for Daily Purchases

When regular costs are charged to credit, it brings about a dependency. Simple purchases are made more costly through the accumulation of interest. Account balances decrease, credit becomes tighter, and flexibility decreases, which means that there are few choices in the case of a true emergency.

Postponing Emergency Savings

Not saving for an emergency is a weakness in your day-to-day finances. Unforeseen maintenance or health demands at the time have to depend on borrowing. This causes pressure, unplanned costs and derailment of other financial priorities which would have been stable through simple preparation.

Making Impulse Purchases Frequently

Impulse buying can be minimal in nature but accumulates rapidly. These purchases decrease the money in reserve, which can be used for scheduled requirements. With time, they erode saving practices and bring chaos, regrets and superfluous burden on monthly budgets.

Overlooking Subscription Payments

Subscriptions that are not used are charged monthly. Minor regular charges have a cumulative decrease effect on saving capacity. These payments go unopened without proper review and reduce overall control, as well as redirect the funds towards more meaningful financial objectives.

Not Tracking Daily Spending

In cases where money is not monitored, money appears to vanish without being noticed. This brings about confusion, undermines budgeting efforts and does not allow timely correction. Clear tracking leads to awareness, which informs making smarter and balanced financial decisions.

Delaying Retirement Contributions

Delaying retirement savings weakens the strength of the long-term growth. Any minor delay influences further stability. Regular contributions at tender ages will lead to greater financial autonomy in future and alleviations in the working years.

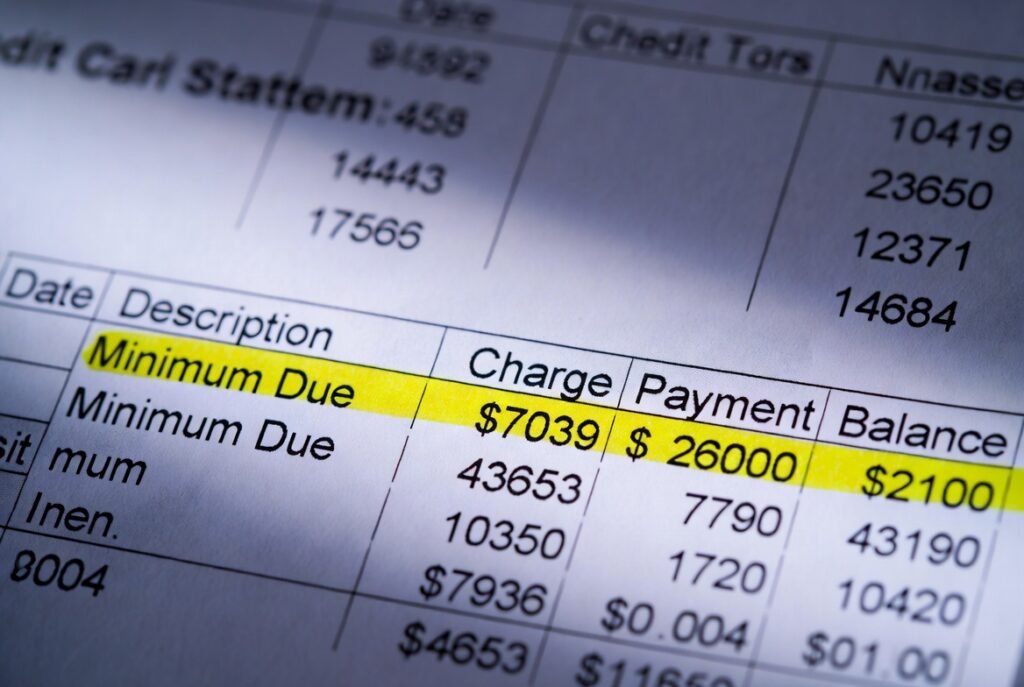

Paying Only the Minimum Due

Minimum payments might appear not so difficult, but they lengthen the time of repayment and raise the level of interest. This slows down monetary development and maintains balances at a greater level, and restricts monthly flexibility.

Avoiding Financial Planning

Goals are not planned, and this makes them vague and improvements unpredictable too. There must be financial direction. Making clear plans enhances confidence, minimises unnecessary stress and generates a sense of purpose behind saving and spending decisions.

Mixing Personal and Household Expenses

The category of individual and household expenditures will cause a mix in budgeting. The responsibility and savings are more difficult to track. Transparency is ensured by clear separation and enhances financial discipline.

Ignoring Small Debts

Small balances that are not paid out swell gradually. They are usually larger burdens that are difficult to handle in future. Timely resolution creates flexibility and helps to avoid prolonged stress.