It is no longer the same when it comes to the handling of money as it was ten years ago. Bills arrive online. Groceries cost more. Minor costs creep on board unnoticed. Better control is desired by many households, not complex systems. Saving money apps can help with the added stress you may feel behind the times, and trying to catch up. And they work in the shadows, without as much as a peep. Some round-up purchases. Others compare prices or terminate unutilized subscriptions. The trick here is the selection of tools that suit our day-to-day life. Pragmatic characteristics are more important than fashion. The following are the trusted applications that facilitate consistent financial patterns and better decision-making. Each of us uses them to serve a different need, but all of us work towards the same objective: helping you keep more of your money.

Rakuten

Rakuten has both online and in-store cash back. You shop as usual. The application tracks qualified purchases and makes payments every three months. It also suits well for households that already shop via the major retailers.

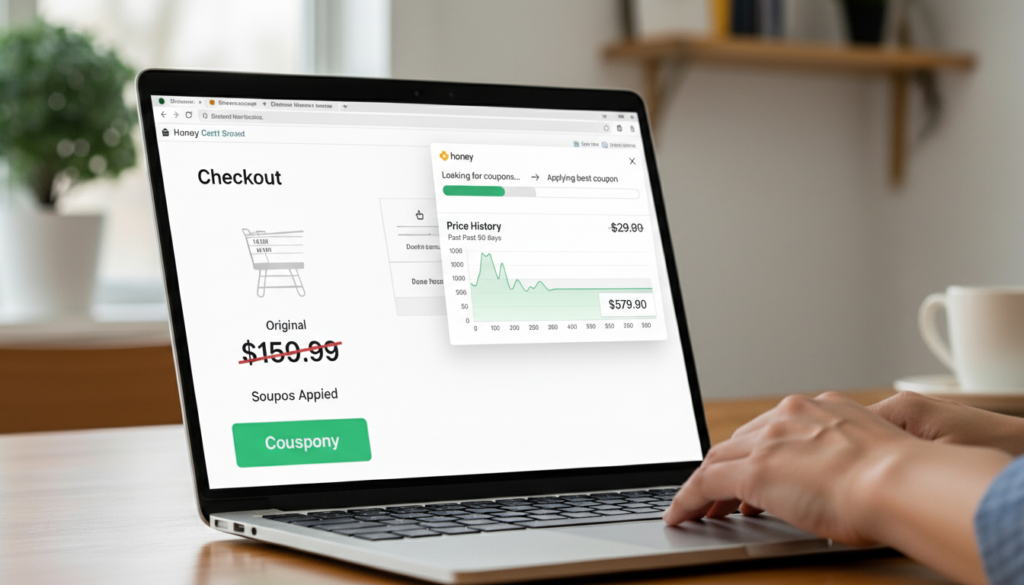

Honey

On the checkout, Honey looks up coupon codes. It uses the existing discounts automatically. The tool will also show the history of prices on the items selected. This assists users in making their purchasing decisions as opposed to paying more than required.

Ibotta

Ibotta specialises in grocery savings. Shoppers choose offers before purchasing. Once they have purchased, they post receipts. Cash back accrues with time. It is effective in families cooking at home and who shop regularly.

Mint

Mint integrates bank accounts, credit cards, and bills into a single interface. It is an automatic categorisation of spending. Clear charts show patterns. This assists the households in changing their habits and identifying areas where money is wasted.

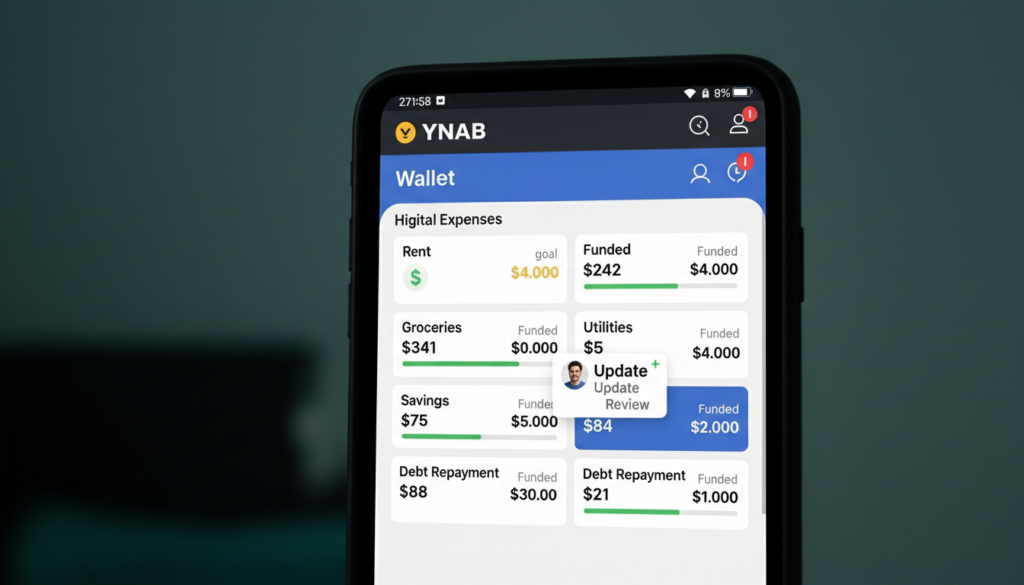

YNAB (You Need A Budget)

YNAB advocates for goal-oriented budgeting. Every dollar receives a job. The system needs to be updated on a periodic basis, yet it creates awareness. It, according to many users, transforms their thoughts when making spending and saving choices.

GoodRx

GoodRx finds the lowest price of prescriptions in pharmacies. The expenses tend to be more expensive than anticipated. The application offers discounts to minimise the out-of-pocket costs. It is particularly applicable to families that have chronic medication requirements.

Acorns

Acorns collects up the change received during buying activities and invests it. Small quantities increase slowly. It is a process that is easy and consistent. It is appropriate for people who do not need the huge initial investments.

Fetch Rewards

Fetch Rewards is a service that provides points when receipts from grocery stores are scanned. Gift cards are gained on the basis of points. The process is quick. It gives incentives to normal shopping instead of having to change the habit of buying.

Trim

Unsubscribe from subscriptions on your accounts. It recognizes reoccurring fees. One can easily cancel the unwanted services. This would avoid the outlay of money in terms of silent monthly fees.

GasBuddy

GasBuddy is a site that compares the prices of fuel at the local stations. There can be differences in price that can appear insignificant. Over months, savings add up. Commuter drivers can usually be the greatest beneficiaries of pre-filling verification.

PocketGuard

PocketGuard displays the leftover amount of money after savings goals and bills. The layout is simple. It will avoid excessively spending money by emphasising the safe amounts that can be used on a daily basis.